New York state’s mammoth pension fund is pulling $111 million in investments out of the firm that owns Ben & Jerry’s because of the ice cream maker’s boycott of Israel’s occupied territories, The Post has learned.

State Comptroller Tom DiNapoli — the sole manager of the $263 billion state Common Retirement Fund — said Ben & Jerry’s decision to stop selling ice cream in the disputed Israeli-Palestinian territories in July violated his office’s policy against the Boycott, Divestment and Sanction of Israel.

As a result, the comptroller is yanking $111 million in equity investments from Unilever, Ben & Jerry’s parent company.

“After a thorough review, the New York State Common Retirement Fund will divest its equity holdings in Unilever PLC. Our review of the activities of the company, and its subsidiary Ben & Jerry’s, found they engaged in BDS activities under our pension fund’s policy,” DiNapoli said in a statement to The Post.

The state comptroller’s policy established in June 2016 said BDS activities are intended to inflict economic harm against Israel and as a result, state pension fund’s investments in the Jewish State. The state pension fund — the nation’s third-largest — invests more than $800 million in retirement funds in Israel.

The policy put companies involved in BDS activities against Israel on notice that the state would yank its pension investments.

“We will be divesting those investments. Ben & Jerry’s engaged in BDS activities,” said a spokesman for DiNapoli.

Allies of Israel applauded DiNapoli for standing up for the Jewish State.

“This is wonderful news. God bless Tom DiNapoli,” said former Brooklyn state Assemblyman Dov Hikind

“BDS equals anti-semitism and Comptroller DiNapoli stood up against hate.”

Hikind and DiNapoli served together for years in the state Assembly and the comptroller personally called Hikind Thursday night to inform him of his action against Unilever/Ben & Jerry’s.

Dinapoli’s director of corporate governance, Liz Gordon, sent a warning notice to Unilever CEO Alan Jope that its subsidiary firm Ben & Jerry was engaging in a BDS action against Israel.

JOPE gave a circular response on August 4 defending Ben & Jerry’s actions, saying it doesn’t intervene in actions taken by the “independent” boards or the “social mission” of its brands.

“Unilever has a strong and longstanding commitment to our business in Israel. We employ nearly 2,000 people in the country across our four factories and head office, and we have invested approximately $250 million in the Israeli market over the last decade,” Jope said in a letter to Gorzon.

The Unilever boss added, “On this decision, it was no different. Ben & Jerry’s has also made it clear that although the brand will not be present in the West Bank from 2023, it will remain in Israel through a different business arrangement.”

Last month, the state of New Jersey started divesting $182 million invested in Unilever stock, bonds and other securities over Ben & Jerry’s boycott of Israel — joining other anti-BDS states including Arizona and Texas.

On July 19, Ben and Jerry’s announced that it would stop selling ice cream to Occupied Palestinian Territory [OPT] saying “it is inconsistent with our values” to conduct business there.

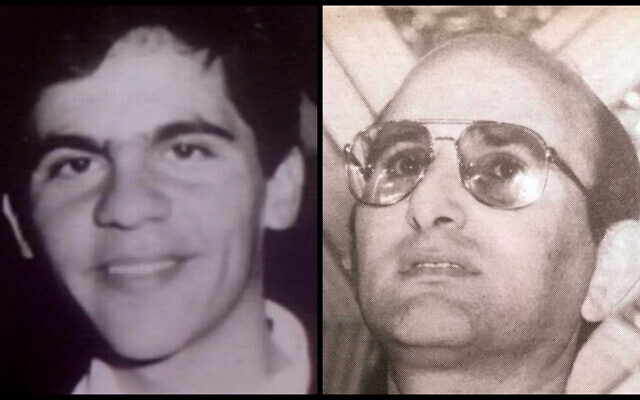

Ben and Jerry’s Jewish cofounders Bennett Cohen and Jerry Greenfield — who sold their namesake company to Unilever in 2000 — defended the company’s decision to end sales in the region in a New York Times editorial in July, writing that Israel was one of the first countries that the company had expanded to internationally as it grew.

The founders, who called themselves “proud Jews” said that it is “possible to support Israel and oppose some of its policies” just as they’ve “opposed policies in the US government.”

Additional reporting by Patrick Reilly